The first thing that you may think if you are a newcomer to Forex is what is Forex backtesting software? Backtesting software is a computer program that lets you test your trading strategies against historical data. The easiest way to look at this software is to consider it as a practice run for a theory or strategy that you want to develop using real data, but not using cash. There are some advantages and disadvantages to backtesting software, though.

For example, one of the most significant upsides to using historical data is that it is real. There is no way of adjusting the results to your advantage. However, on the other side of the coin is that the concept relies solely on the principle that future trading results will mimic those historical results to an extent.

What that means is that you are probably going to lose money if you only ever let a computer program do all of the work for you. We, as traders, need to understand the reasons behind fluctuations in the Forex market, and be able to predict them because of recent events, not only rely on historical information. That is because there is not likely to be another Black Wednesday again any time soon, and if there is, a computer program will not do as good a job as a person at spotting it.

Why Should You Try Forex Backtesting Software?

Contents

Although at this point, backtesting seems like a bleak and pointless waste of time, it isn’t. There are still some significant upsides to trying it out. They are:

- Practicing. - Technical analysis is something that you can only learn first hand. That means that you can read all of the books in the world, but with no practical experience, you are going to fall short of making money. That is true for any profession, but the problem with Forex is that you could actually lose money. Understanding opportunities, and taking advantage of them when they arise, through the use of patterns is going to help you a tremendous amount.

- Confidence. - Practicing your theories will give you more confidence in using them in real-life situations. The more you practice, the more you will become knowledgeable about the market, what may happen, and how that will affect your position if you trade. While this confidence will not all transfer over to a real situation with your own money, some of it will. Then you can begin to get more confidence in actual trades.

- Insight. - When you practice, you will gain confidence, as we have already said. However, both of those will transfer into an idea that you can use to your advantage. You will still have to see if your strategies will transfer into live trading, but gaining some insight into what works and don’t will undoubtedly help you.

Manual or Automated Forex Backtesting?

Manual backtesting is not a new thing. It was the original form of backtesting in the 1980s, and it is still used today. However, not quite as much as it was back then, and understandably so. The process is exactly as it sounds, look at the data charts, and observe what happened and when. Anyone can do manual backtesting, but there are going to be people that are faster and better than others. Likewise, there will be people who find it too laborious and slow, thus will not want to spend the time and effort that is required.

Manual is better for newbies as it gives you a deeper understanding of what is happening and why. It is one of the better ways to put the above points into practice and getting more information than you would with a computer system.

Many manual backtests use excel spreadsheets to do the calculations for you, as it can be quite tricky using pen and paper. We will go through the formula of manual excel backtest sheets in a different article, as this is not what we are looking at today.

So, back to the question, manual or automated Forex backtesting? Honestly, this all depends on how much time you have and want to put into it. If you have a significant amount of time, then you will probably garner better results from manual backtesting, but it does need time and dedication. So, we will look through the automated systems in this article.

Automated Forex Backtesting

Because of the ease of use of any automated Forex backtesting software, in comparison to manual testing, it may be worth you looking through the options before you go into manual backtesting. However, one piece of advice, do not forget to spend at least a little time doing manual testing, as it provides you with a better understanding of what happens and when.

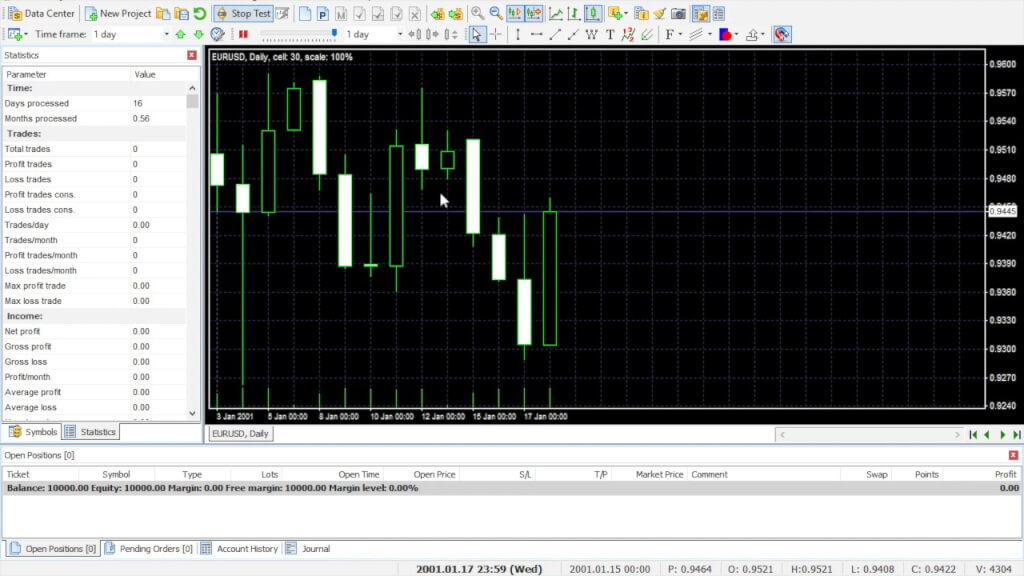

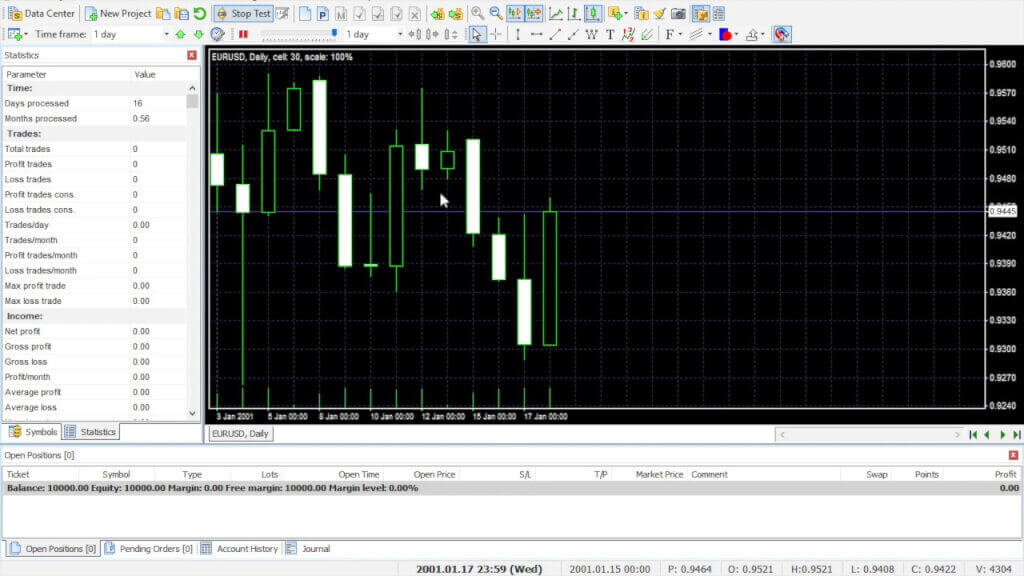

MT4 (Meta Trader 4) Backtesting

MT4 is arguably the most common platform in the world for Forex traders. Downloading it and having a play with a demo account is going to help you get a feel for the real thing, even if you do not use it for backtesting. Some of the key benefits include:

- The most popular trading simulator

- Strategy Tester

- Free

- Economic calendar (including important news releases)

- Offline charts with indicators, templates, and tools

- Nearly ten years of data available

- Multiple charts open at the same time

- In-built and custom indicators

- Savable simulations

Using the MT4 platform for backtesting is likely to be one of the most beneficial ways that you will gain any confidence and insights into the real world of trading without having to risk your money.

Forex Backtesting Software - Soft-FX

Soft-FX is an MT4 plugin, so first things first, you will need to have MT4 installed and open before you get Soft-FX. While this isn’t entirely free software, you can try it for free, then buy the full program if you find that it works well for you.

There are a lot of options within the Soft-FX backtesting software, and they are available to you as soon as you open up the program. Within the provider section, you may want to choose MetaTrader. However, doing that will give you a warning advising you that there may be fewer data available, and a link will point you here.

One of the things that I noticed, other than the simplicity of it, is that you do need to download each currency pair separately, and they can take a while to download. However, that is a sign of excellent backtesting software, as the data is downloaded from around 2003, so there is plenty of backtesting availability. Furthermore, it is very easy to set stop loss and take profit lines by dragging and dropping the lines.

What it doesn’t include are things like the economic calendar and multiple charts. But, if you are a newcomer, or you only want to test one currency pair, that is not much of an issue.

TradeInterceptor

TradeInterceptor, as it is more commonly known, has changed its name to ThinkMarkets. Some people have found that there is a lot of mess with the older TradeInterceptor backtesting software. However, that has changed with the recent branding update and name change, The interface has become a lot smoother and visually appealing. Moreover, it is more of a responsive platform than the MT4, even with simple differences such as mouse wheel scrolling for zooming. Another excellent addition to TradeInterceptor (ThinkMarkets) is that you do not have to pay to have more than one chart open at one time.

Even though we are looking at manal Forex backtesting software, it is worth mentioning that this program has got five preset templates for automating your backtesting trades, which is something that is pretty useful, even if it is for learning your own strategies. Some of the main points are:

- Free to use

- Multiple charts

- Multiple timeframes

- Preset templates

- Customizable indicators

- Data from 2002 onward

- Multiple operating systems

One thing that I am a little disappointed with, though, is that there are no menu options in the program itself. That can make it challenging to learn. However, once you have got the hang of it, it is a very useful tool.

Forex Backtesting Software - Conclusion

While this article is only a brief look at what some of the best Forex backtesting software is, we believe that we have covered the primary three programs that people use. That is not to say that there are no others out there, of course, there are. There are many backtesting software programs available, and finding the one for you is as individual as finding the strategy that suits you.

Our advice though is trying all three of these in the free version and see which one suits you and your computer/mobile setup the best. There are some programs that are a little more CPU intensive than others, such as the TradeInterceptor. However, it does have a few more features, such as multiple charts. So, if you have a setup that will run it the way you want it to, then you should certainly try it.

Backtesting is a critical aspect of learning to trade, and even the most experienced traders still do it. Therefore, you want to backtest as much as you can.